Nearly seven out of ten Americans believe estate planning matters, yet only about a third have even a basic will, according to Caring.com’s 2024 survey.

Duffley Law is here to close that gap. We create estate plans crafted for peace of mind, designed to keep your family out of probate, and always tailored to your real-life needs. You’ll find clear answers, up-front pricing, and kindness in every interaction, so you can make smart decisions for your loved ones without surprises.

Key Takeaways:

- Estate planning is important for everyone and helps avoid confusion, court costs, and delays.

- Following a simple checklist that includes listing assets, choosing beneficiaries, and articulating your wishes makes the process manageable.

- Tools like living trusts and transfer-on-death deeds in Texas can help your family avoid probate court and receive assets faster and more privately.

What Is Estate Planning and Why Does It Matter?

Estate planning means taking control of who inherits your assets, who manages things if you can’t, and how your family is cared for when you’re gone.

It’s not just for the wealthy, it’s for anyone who wants to avoid confusion, court battles, and extra costs later on.

Good estate planning spells out your wishes and keeps your loved ones out of probate court. In Texas, estates over $75,000 usually must go through probate, which can take months and cost thousands of dollars.

With the right documents, wills, trusts, and beneficiary designations, you can keep things clear, save money, and give your family peace of mind.

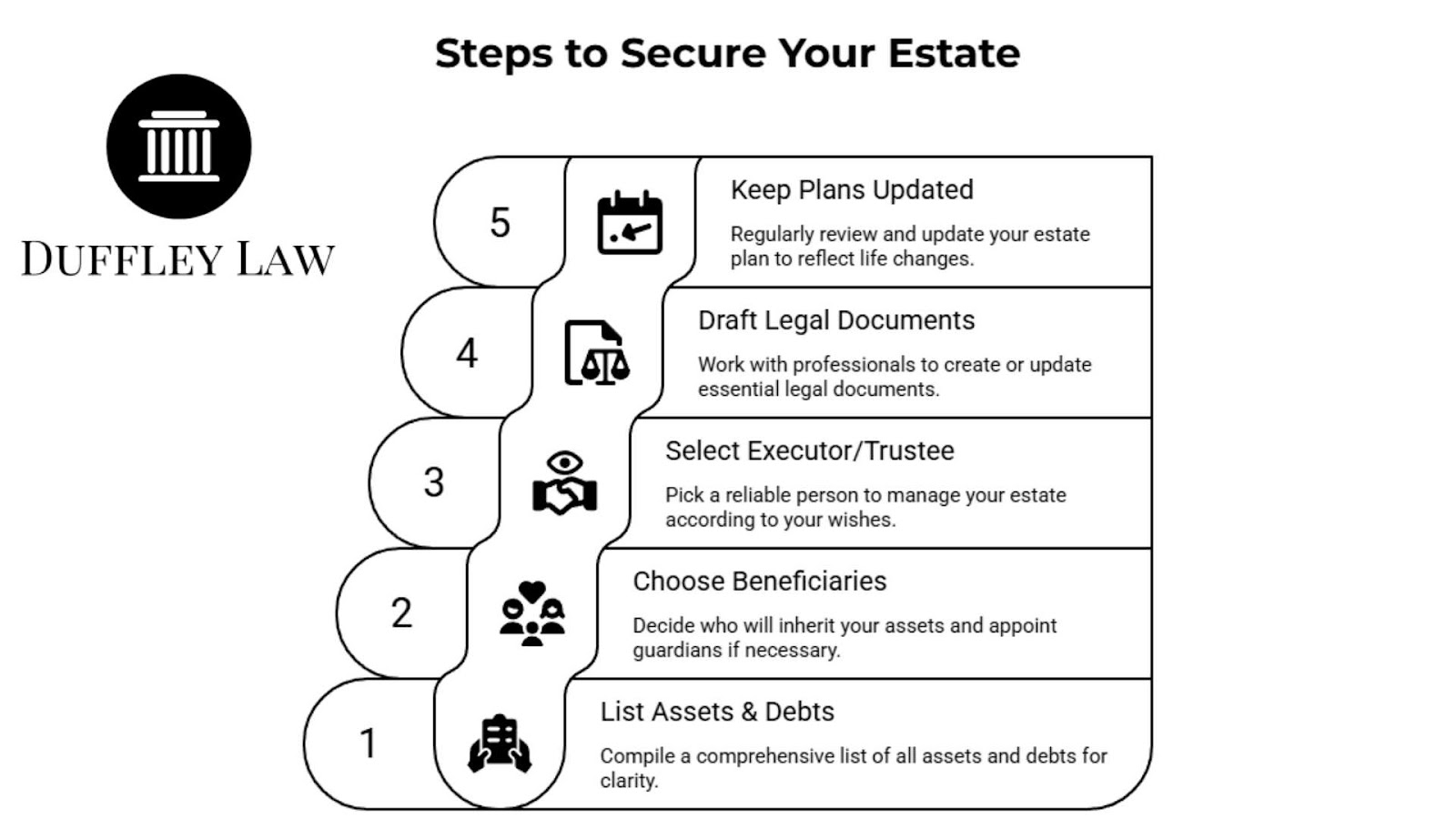

Step-by-Step Estate Planning Checklist

Here are some steps to help cover your bases and give your family real peace of mind with an effective estate plan:

1. List Your Assets and Debts

Start by listing everything you own: your home, your car, your bank accounts, your investments, and any significant personal items. List any debts you have as well.

An up-to-date list makes your decisions clear and helps your executor or trustee handle things smoothly.

2. Choose Your Beneficiaries and Guardians

Decide who gets what. If you have minor children, pick a trusted adult to be their guardian. These choices are personal and important, so don’t rush them!.

3. Select a Trusted Executor or Trustee

Pick someone organized and reliable to carry out your wishes. This person doesn’t have to be a lawyer or professional, but it should at least be someone you can trust.

4. Draft and Review Your Legal Documents

Work with a professional to create or update your will, living trust, powers of attorney, healthcare directives, and any other documents to create an effective estate plan.

5. Keep Plans Updated as Life Changes

Major life events, marriage, divorce, and a new child should prompt a review. Even without big changes, check periodically to see if it makes sense to update your estate plan.

How to Avoid Probate in Texas?

Probate is a court process that can delay inheritance, add costs, and make private estate matters public.

How Living Trusts Help

A living trust lets you transfer assets directly to your chosen heirs, skipping probate entirely. You can stay in control while you’re alive, and then your trustee handles things fast and privately if something happens to you.

Beneficiary Deeds and Transfer-on-Death Tools

Texas allows you to pass real estate and many financial accounts straight to beneficiaries with a simple deed or form. This keeps those assets out of court and speeds up the process for your family.

Common Probate Pitfalls in Texas

Many people forget to update beneficiary designations or leave out certain assets from their estate plans. That’s when problems pop up, delays, extra fees, or even disputes among heirs.

About 2.6 million probate cases are filed each year nationwide, based on data from the National Center for State Courts, but a little planning can avoid that hassle for your family.

Frequently Asked Questions About Estate Planning

Do I really need a will if I don’t own much?

Even if you don’t have a lot, a will helps make sure your belongings go where you want. Without one, state law decides.

How often should I update my estate plan?

Check your documents periodically or after big life changes like marriage, divorce, or the birth of a new child.

Is estate planning only for the wealthy?

Not at all. Estate planning is for anyone who wants control over what happens to their stuff and who cares for loved ones.

What if my family has special needs, blended situations, or unique requirements?

A custom plan can be extremely helpful. Look for an attorney who listens and builds your plan around your goals and your family’s situation, not just using a generic template that doesn’t reflect your needs.

Ready to Plan with Confidence?

At Duffley Law, we’re about making the process straightforward and built for your goals. You get clarity at every step, no surprise costs, and solutions that allow for bypassing the time and expense of probate. Your peace of mind matters.

Ready to take care of what’s next? Here’s our contact page to see how our team can help you reach your goals.