Probate is the court process for retitling someone’s assets after death.

In Texas, you can often avoid probate court entirely by planning ahead with things like beneficiary designations, payable-on-death accounts, transfer-on-death deeds, survivorship agreements, or a properly funded living trust. Families choose these routes because they tend to be much faster, more private, and more predictable.

Costs add up when you rely on probate alone. Probate in Texas typically means thousands in legal fees and court costs. And proceedings often take months, if not longer. The right setup keeps your family out of court.

At Duffley Law, you get upfront pricing and a Texas-specific plan tailored to your goals. We consider the cleanest non-probate path for each asset, fix beneficiary gaps, and make sure the deed and assetlanguage matches your goals.

Key Takeaways

- Probate in Texas can be slow, costly, and public, so planning ahead helps families avoid court.

- Best tools include a properly funded living trust, transfer on death deed, POD/account beneficiaries, and survivorship ownership for certain assets.

- A will on its own doesn’t avoid probate. Proper titling, signatures/recording, and updated beneficiaries are what keep assets out of court.

What Is Probate and Why Do People Avoid It in Texas?

Probate is the legal process a Texas court uses to confirm someone’s death, validate a will if one exists, appoint a personal representative, and transfer ownership of assets. If there is no will, the court also decides who inherits under Texas intestacy laws.

Even though Texas probate can be simpler than in some states, it still comes with real downsides. The process often takes several months, and in contested cases, it can stretch well over a year. During that time, assets may be frozen, making it harder for families to access money, sell property, or settle financial obligations.

Cost is another reason people look for alternatives. Probate expenses can include court filing fees, attorney fees, executor fees, and appraisal costs.

As reported by ClearEstate, probate commonly costs between 1% and 5% of an estate’s total value. For many families, that means thousands of dollars paid out simply to transfer assets that could have passed automatically with proper planning.

Privacy also matters. Probate filings are public records in Texas. Anyone can see what assets were owned, who inherited them, and how disputes were handled. Many families prefer to keep financial details and family matters private.

Because of these issues, Texans often choose probate-avoidance tools that allow assets to transfer directly to loved ones. When done correctly, these tools can:

- Shorten the timeline for receiving assets

- Reduce or eliminate court involvement

- Keep family finances private

- Lower overall costs and stress

The key is understanding which assets can bypass probate and which planning method actually works under Texas law. That’s where the right strategy makes all the difference.

6 Proven Ways to Avoid Probate in Texas

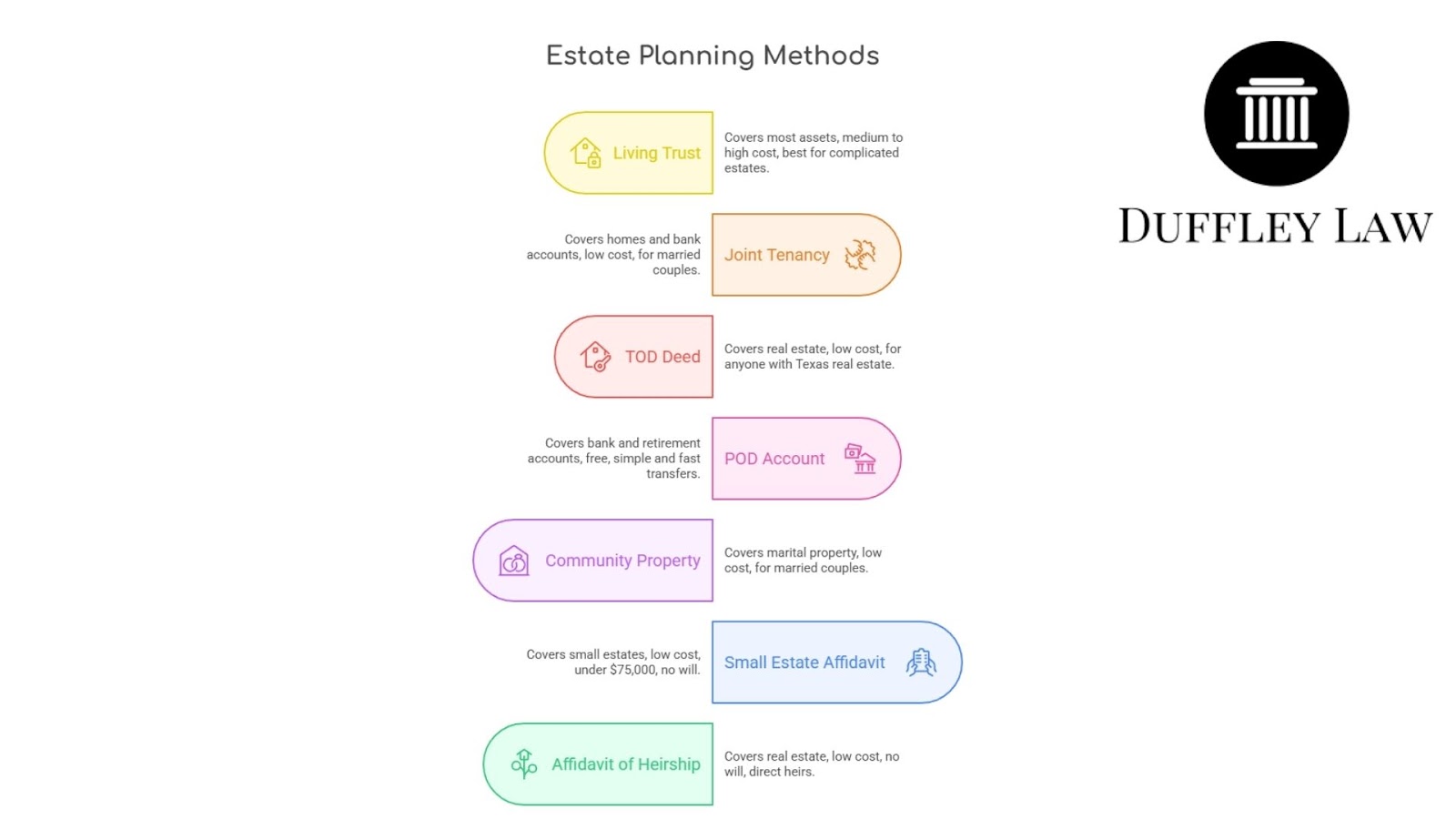

Texas law gives you several tools to transfer assets directly to your loved ones without court involvement. The right option depends on what you own, how it is titled, and who you want to protect.

Below are the most reliable probate-avoidance methods used in Texas estate planning.

1. Establishing a Revocable Living Trust

A revocable living trust lets you move assets out of your individual name and into a trust you control during your lifetime. Because the trust owns the assets, nothing needs to pass through probate when you die.

To make a trust work in Texas:

- The trust must be properly drafted

- Assets must be retitled into the trust

- Beneficiaries must be clearly named

When funded correctly, a living trust can cover real estate, bank accounts, investments, and business interests. This option works best for larger estates, blended families, or situations where you want control over how and when assets are distributed.

A trust does not eliminate debts or taxes, but it avoids court involvement and keeps transfers private.

2. Joint Ownership With Right of Survivorship

Joint tenancy with right of survivorship allows property to pass automatically to the surviving owner at death. This method is commonly used by married couples, but it can also apply to bank accounts and other jointly owned assets.

For this to work in Texas:

- The survivorship language must be clearly stated in writing

- Both owners must sign the agreement

When one owner dies, the survivor becomes the sole owner without probate. This option is simple and low-cost, but it can create issues if used carelessly, especially in second marriages or when children from prior relationships are involved.

3. Transfer-on-Death (TOD) Deeds for Texas Real Estate

A Transfer-on-Death Deed lets you name a beneficiary to receive real estate when you die, without giving up ownership during your lifetime.

To use a TOD deed:

- The deed must be signed and notarized

- It must be recorded with the county clerk before death

- The beneficiary has no ownership rights until you pass away

TOD deeds are popular because they are inexpensive and easy to revoke. They work well for homesteads, rental property, and vacant land, as long as the deed is properly prepared and recorded.

4. Payable-on-Death (POD) Accounts and Beneficiary Designations

Many financial accounts allow you to name a beneficiary who receives the funds automatically at death.

These include:

- Bank accounts

- Retirement accounts

- Life insurance policies

- Investment accounts

To set this up:

- Contact your financial institution

- Complete the beneficiary or POD form

- Keep the designation updated

When you die, the money passes directly to the named beneficiary without probate. This is one of the easiest ways to avoid court, but it only works if the forms are accurate and current.

5. Community Property With Right of Survivorship

Married couples in Texas can sign a community property survivorship agreement. This allows the surviving spouse to automatically receive the deceased spouse’s share of community property.

This option:

- Applies only to married couples

- Requires a written, signed agreement

- Keeps marital property out of probate

It works well for couples who want everything to pass to the surviving spouse first, but it may not be ideal for blended families or second marriages without additional planning.

6. Small Estate Affidavit and Affidavit of Heirship

For smaller estates, Texas offers simplified options.

A Small Estate Affidavit can be used when:

- There is no will

- Non-exempt assets total $75,000 or less

- The estate qualifies under Texas law

An Affidavit of Heirship may help transfer real estate when someone dies without a will. While not a full substitute for probate, it can clear title over time when uncontested.

These tools work best for simple estates with cooperative heirs and limited assets.

Comparison Table: Probate Avoidance Methods in Texas

Each probate-avoidance tool works a little differently. Some are fast and simple, while others offer more control but require more setup. This table helps you see which option fits your assets and family situation.

| Method | Assets Covered | Cost & Setup | When It Works Best | Key Limitations |

| Revocable Living Trust | Most assets, including real estate, bank accounts, investments, business interests | Medium to high upfront cost | Larger estates, blended families, detailed distribution plans | Must be properly funded or assets may still go to probate |

| Joint Ownership with Right of Survivorship | Homes, bank accounts, some investments | Low cost | Married couples or trusted joint owners | Can cause problems in second marriages or creditor exposure |

| Transfer-on-Death (TOD) Deed | Texas real estate only | Low cost, simple filing | Homeowners who want an easy real estate transfer | Does not manage debts or multiple beneficiaries well |

| POD Accounts / Beneficiary Designations | Bank accounts, retirement accounts, life insurance | Usually free | Fast, direct transfers of financial accounts | Outdated forms or missing beneficiaries cause issues |

| Community Property with Right of Survivorship | Marital community property | Low cost | Married couples wanting everything to pass to spouse | Not ideal for blended families without extra planning |

| Small Estate Affidavit | Small estates under $75,000 (excluding homestead) | Low cost | Simple estates with no will and cooperative heirs | Strict limits and court approval still required |

| Affidavit of Heirship | Real estate | Low cost | No will, uncontested family situations | Not immediate and may not work for disputed estates |

How to Choose the Right Way to Avoid Probate in Texas

The best probate-avoidance plan depends on what you own, how it is titled, and who you want to protect.

Review Your Assets

If you own Texas real estate, a Transfer-on-Death Deed is often the simplest solution. It keeps the property in your name during your lifetime and transfers it automatically at death. If you own multiple properties, have minor beneficiaries, or want added protection for a spouse or children, a living trust may offer better control.

For bank accounts, retirement accounts, and life insurance, beneficiary designations or payable-on-death instructions usually work best. These transfers are fast and do not involve court, but only if the forms are completed correctly and kept up to date.

If you are married, ownership structure matters. Community property with right of survivorship can keep marital assets out of probate, but it works best when everything is meant to pass to the surviving spouse. In second marriages or blended families, this approach can create conflicts if children from prior relationships are involved.

Incorporate Your Family

If you have a blended family, a beneficiary with special needs, or concerns about how or when assets are distributed, a revocable living trust offers more protection and flexibility.

Cost and Effort

Some probate-avoidance tools cost little or nothing to set up, while trusts require more upfront planning. The tradeoff is control. Trusts allow you to set rules, timelines, and protections that basic forms cannot provide.

Estate Size

If the estate is small and there is no will, a Small Estate Affidavit may be available. However, this option has strict limits and does not work for every situation.

When multiple tools are coordinated correctly, probate can often be avoided entirely. A Texas estate planning attorney can help confirm that each asset is covered and that the plan works together as a whole.

Does a Will Avoid Probate in Texas?

No. A will does not avoid probate in Texas.

A will only tells the court who should receive your assets and who should manage your estate. It still has to be filed with the probate court and approved by a judge before anything can be transferred.

In fact, a will is what triggers probate.

Under Texas law, a will generally must be admitted to probate within four years of the date of death. If that deadline is missed, the estate may be treated as if there were no will at all, which can lead to additional court involvement and complications.

Many people assume that having a will means their family will avoid court. In reality:

- A will does not transfer assets by itself

- A will does not keep matters private

- A will does not speed up access to property or money

Probate may be simpler when there is a will, especially if it allows for independent administration, but it is still a court process with filings, timelines, and public records.

Assets only avoid probate when they are set up to pass outside the will. This includes:

- Property held in a living trust

- Accounts with POD or beneficiary designations

- Real estate with a Transfer-on-Death Deed

- Property owned with right of survivorship

A will is still an important document. It names guardians for minor children, appoints an executor, and acts as a safety net for assets that were not properly titled. But on its own, it does not keep an estate out of probate.

That is why effective Texas estate plans use a will together with probate-avoidance tools, not instead of them.

5 Common Mistakes That Can Still Lead to Probate in Texas

Even with good intentions, small errors can push an estate into probate anyway. These are the most common problems Texas families run into.

1. Leaving Assets Out of the Plan

Probate avoidance only works for assets that are properly set up. If a bank account, vehicle, or piece of real estate is left in your individual name with no beneficiary or survivorship language, that asset will likely go through probate.

This often happens when:

- A trust is created but never funded

- New accounts are opened without updating beneficiaries

- Property is purchased after the estate plan is signed

Every major asset should be reviewed and matched to a non-probate transfer method.

2. Assuming a Will Is Enough

A will does not avoid probate in Texas. It only gives instructions to the court.

Many people create a will and stop there, believing their family is protected. In reality, the will must still be filed with the probate court, approved by a judge, and carried out through the probate process.

Without additional planning, a will alone guarantees probate rather than avoiding it.

3. Using the Wrong Forms or Missing Legal Requirements

Texas probate-avoidance tools are very specific about how they must be created.

Common errors include:

- TOD deeds that are never recorded

- Survivorship agreements that are not signed correctly

- POD forms filled out incorrectly or missing beneficiaries

If a required step is skipped, the transfer may fail and force the asset into probate.

4. Forgetting About Debts and Creditor Claims

Avoiding probate does not eliminate debts.

Creditors still have the right to be paid, even when assets pass outside of probate. If the estate plan does not account for debts, taxes, or final expenses, surviving family members may face unexpected legal and financial issues.

Planning should always include a strategy for handling liabilities, not just transferring assets.

5. Relying on DIY Templates or Outdated Advice

Online forms and generic templates often fail to account for Texas-specific laws. Even small drafting errors can invalidate a deed, beneficiary designation, or trust provision.

Texas estate law also changes over time. What worked years ago may no longer work today. Mistakes in DIY plans frequently result in court involvement that could have been avoided with proper guidance.

Working with a Texas estate planning attorney helps make sure every document is valid, current, and coordinated with the rest of your plan.

Plan Ahead and Bypass Probate With Confidence

Keeping your estate out of court is about making sure every asset is aligned with the right legal tool under Texas law. When the pieces work together, your family avoids delays, extra costs, and unnecessary stress during an already difficult time.

At Duffley Law, the process starts with clarity. You know the cost up front, you understand your options, and every recommendation is tailored to your assets and family situation.

If you are ready for straightforward Texas estate planning designed to bypass probate and protect your loved ones, visit our contact page to schedule a consultation. The sooner your plan is in place, the easier things will be for the people you care about most.